tax forgiveness credit pa

To submit a dispute online visit Experians. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program.

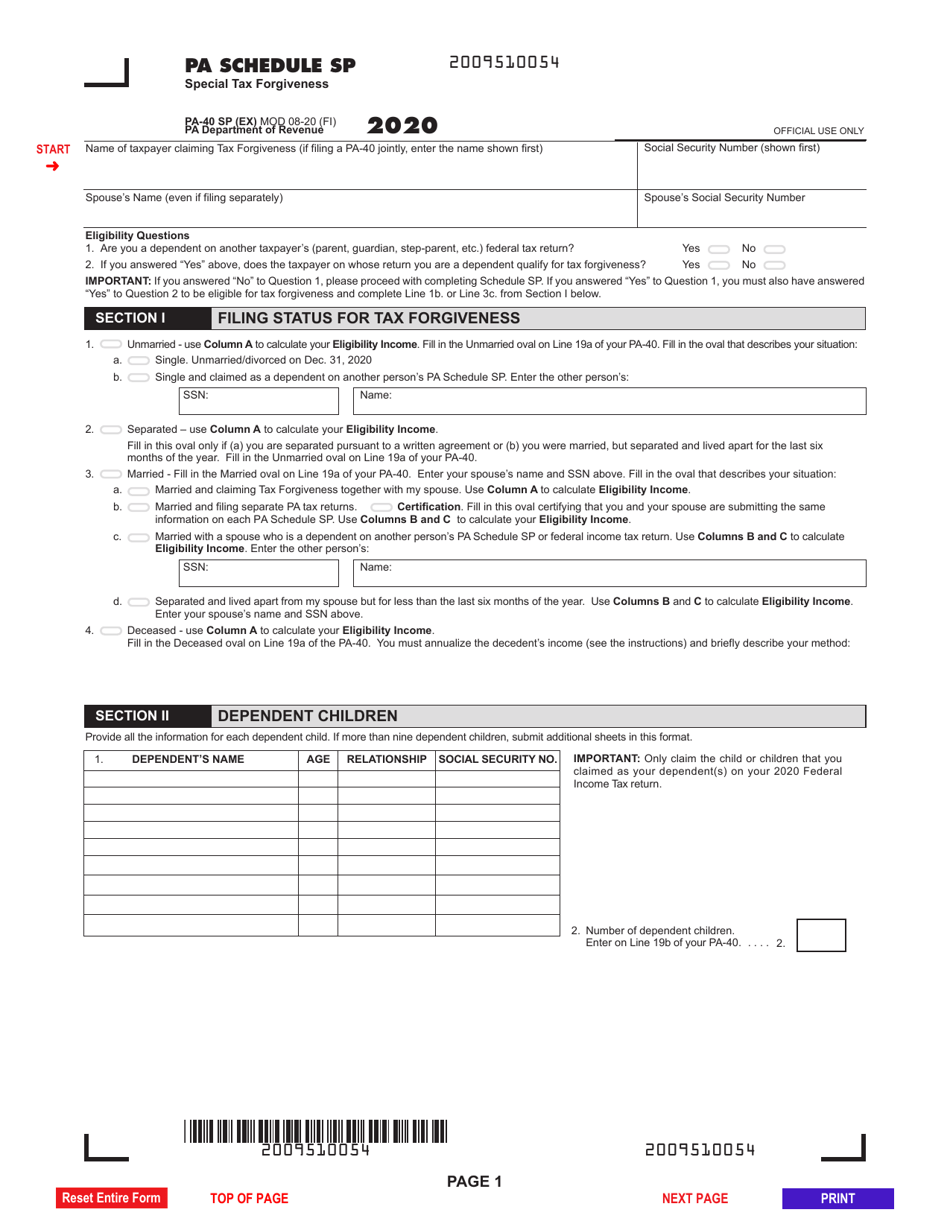

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

For more information visit the Internal Revenue Services at www.

. 2022 Individuals Estimated Income Tax Worksheet. Get REV-414-I e-File with TurboTax. Get Form REV-637 e-File with TurboTax.

Tax Forgiveness for PA Personal Income Tax Brochure. 2021 Unreimbursed Allowable Employee Business Expenses Brochure. Irsgov or call the IRS toll-free 1-800-829-1040Taxpayers eligible for PA Tax Forgiveness may also qualify for the federal earned income tax credit.

Personal credit report disputes cannot be submitted through Ask Experian. Get Form REV-631 e-File with TurboTax. Visit the Internal Revenue Services.

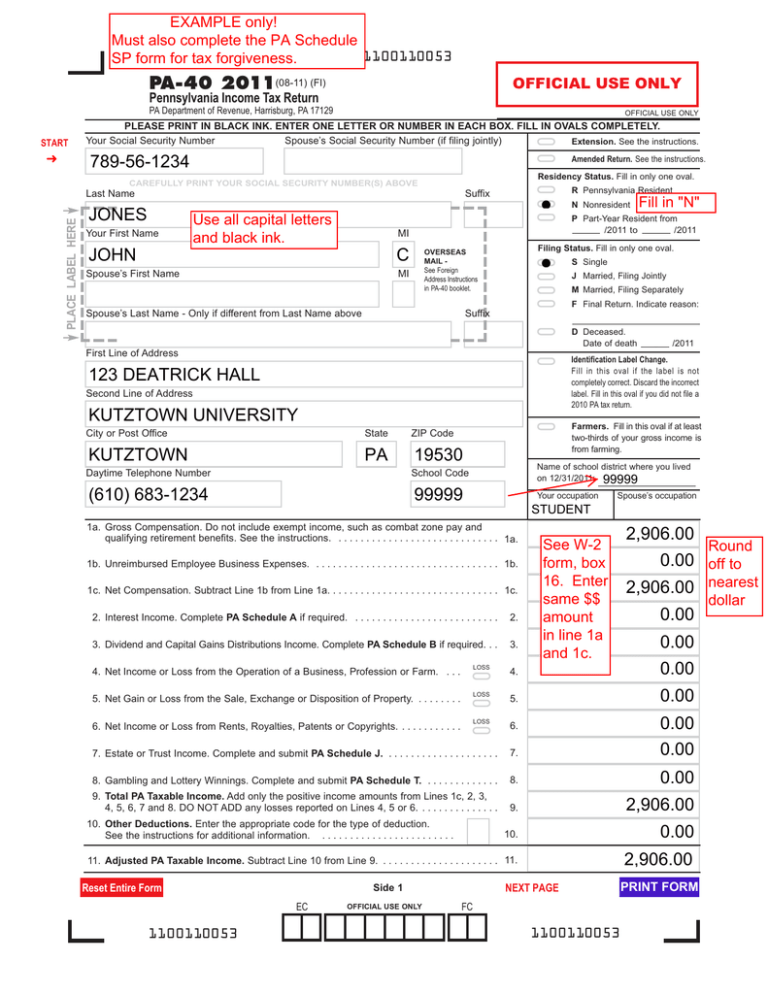

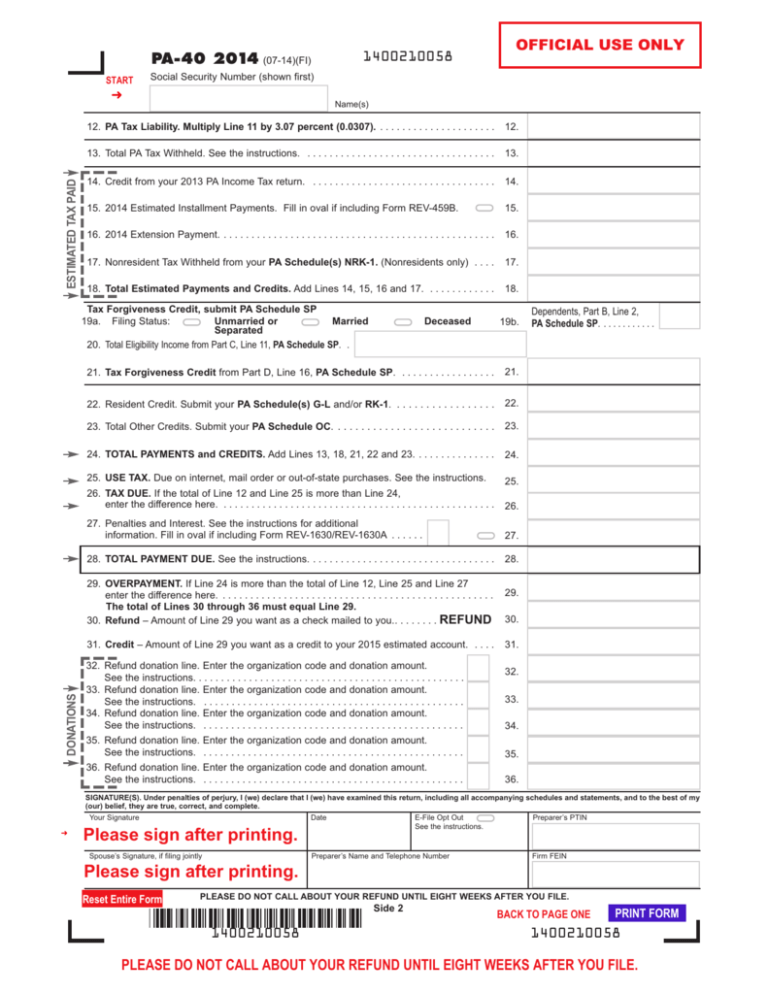

Your personal credit report includes appropriate contact information including a website address toll-free telephone number and mailing address. To dispute information in your personal credit report simply follow the instructions provided with it. An amended PA Schedule SP must be included with Sched-ule PA-40 X if increases or decreases in income amounts.

Any taxpayers claiming the Tax Forgiveness Credit on Line 21 of the PA-40. Or changes to any information in Parts A B or C of PA Schedule SP are discovered after an original or other amended return is filed with the department. Section III on Page 2 of.

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Fillable Online 2000 Pa Schedule Sp Special Tax Forgiveness Credit Pa 40 Sp Forms Publications Fax Email Print Pdffiller

Tax Season In 2022 Tax Season Tax Services Tax Advisor

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Debt Relief Best Mortgage Lenders